Decoding Alibaba Group’s Net Worth: A Comprehensive Analysis

Understanding the Alibaba Group net worth is crucial for investors, analysts, and anyone interested in the global e-commerce landscape. The Alibaba Group net worth isn’t just a single number; it’s a dynamic figure influenced by a multitude of factors, including stock performance, market conditions, and strategic business decisions. This article delves into the complexities of evaluating Alibaba Group’s net worth, providing a comprehensive analysis of its key components and the forces that shape it.

Factors Influencing Alibaba’s Net Worth

Several elements contribute to the overall Alibaba Group net worth. These factors can be broadly categorized into financial performance, market dynamics, and strategic initiatives.

Financial Performance

At the core of Alibaba Group net worth lies its financial performance. Key metrics include:

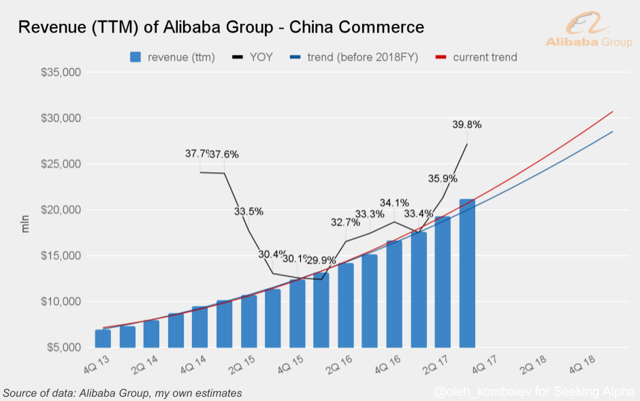

- Revenue Growth: Sustained revenue growth across its core e-commerce businesses, cloud computing, and digital media segments significantly boosts Alibaba Group’s net worth.

- Profit Margins: Healthy profit margins indicate efficient operations and strong pricing power, contributing positively to the overall valuation.

- Earnings per Share (EPS): Rising EPS signals profitability and attracts investors, driving up the stock price and, consequently, the Alibaba Group net worth.

- Free Cash Flow: Strong free cash flow allows for investments in growth initiatives, acquisitions, and share buybacks, all of which can enhance shareholder value and the Alibaba Group net worth.

Market Dynamics

External market forces also play a significant role in determining the Alibaba Group net worth:

- E-commerce Market Growth: The overall growth of the e-commerce market, particularly in China and Southeast Asia, provides a tailwind for Alibaba’s business.

- Competition: The competitive landscape, including rivals like JD.com, Pinduoduo, and Amazon, can impact Alibaba’s market share and profitability. [See also: Analyzing the Competitive Landscape of E-commerce in China]

- Regulatory Environment: Government regulations, especially in China, can significantly influence Alibaba’s operations and future growth prospects. Recent regulatory scrutiny has had a noticeable impact on Alibaba Group’s net worth.

- Macroeconomic Conditions: Economic growth, inflation, and interest rates can all affect consumer spending and business investment, impacting Alibaba’s financial performance.

Strategic Initiatives

Alibaba’s strategic decisions and investments also have a direct impact on the Alibaba Group net worth:

- Investments in New Technologies: Investments in cloud computing, artificial intelligence, and other emerging technologies can drive future growth and enhance the company’s competitive advantage.

- Acquisitions and Partnerships: Strategic acquisitions and partnerships can expand Alibaba’s market reach, diversify its business, and create synergies that boost shareholder value.

- International Expansion: Expanding into new markets can unlock new growth opportunities and diversify revenue streams, contributing to the Alibaba Group net worth.

- Innovation and Product Development: Continuous innovation and the development of new products and services are essential for maintaining a competitive edge and driving long-term growth.

Methods for Estimating Alibaba’s Net Worth

Several methods can be used to estimate the Alibaba Group net worth. Each method has its own strengths and weaknesses, and a combination of approaches is often used to arrive at a more accurate valuation.

Market Capitalization

Market capitalization, calculated by multiplying the current stock price by the number of outstanding shares, is the most readily available measure of a company’s value. While it provides a snapshot of investor sentiment, it can be volatile and doesn’t always reflect the underlying fundamentals of the business. Keep in mind that the market cap represents the value the market assigns, which is subject to change based on news, rumors, and economic conditions. The fluctuations in the market cap directly affect the perceived Alibaba Group net worth.

Asset-Based Valuation

This method involves summing up the value of Alibaba’s assets, such as cash, investments, and property, plant, and equipment (PP&E), and subtracting its liabilities. While this approach provides a more conservative estimate of value, it can be difficult to accurately assess the fair market value of all assets, especially intangible assets like brand reputation and intellectual property. It often provides a lower bound for the Alibaba Group net worth.

Discounted Cash Flow (DCF) Analysis

DCF analysis involves projecting Alibaba’s future free cash flows and discounting them back to their present value. This method requires making assumptions about future revenue growth, profit margins, and discount rates, which can be challenging. However, it provides a more comprehensive view of the company’s intrinsic value based on its expected future performance. This is a forward-looking method for estimating the Alibaba Group net worth.

Relative Valuation

This approach involves comparing Alibaba’s valuation metrics, such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and enterprise value-to-EBITDA (EV/EBITDA), to those of its peers. This method can provide insights into whether Alibaba is overvalued or undervalued relative to its competitors. [See also: Comparing Valuation Metrics: Alibaba vs. Its Competitors] However, it’s important to consider the specific characteristics of each company and the differences in their growth prospects.

Challenges in Valuing Alibaba

Valuing Alibaba presents several unique challenges:

- Complex Corporate Structure: Alibaba has a complex corporate structure with numerous subsidiaries and affiliates, making it difficult to fully understand its financial performance.

- Regulatory Uncertainty: The regulatory environment in China is constantly evolving, creating uncertainty about Alibaba’s future growth prospects.

- VIE Structure: Alibaba operates through a Variable Interest Entity (VIE) structure, which raises concerns about legal ownership and control.

- Data Availability: Access to detailed financial information about some of Alibaba’s subsidiaries and affiliates can be limited.

The Impact of Regulatory Changes on Alibaba’s Valuation

Recent regulatory changes in China have had a significant impact on the Alibaba Group net worth. Increased scrutiny of technology companies, particularly in areas such as antitrust and data privacy, has led to greater uncertainty and a decline in investor confidence. The cancellation of the Ant Group IPO, for example, had a substantial negative impact on Alibaba’s valuation. These regulatory headwinds continue to weigh on the Alibaba Group net worth.

Future Outlook for Alibaba’s Net Worth

The future outlook for the Alibaba Group net worth is uncertain but remains potentially positive. While regulatory challenges and increased competition pose risks, Alibaba’s strong financial performance, investments in new technologies, and international expansion efforts could drive future growth. The company’s ability to adapt to the changing regulatory landscape and maintain its competitive edge will be crucial in determining its long-term valuation. The potential for growth in Southeast Asia and other emerging markets provides opportunities to increase the Alibaba Group net worth.

Conclusion

The Alibaba Group net worth is a complex and dynamic figure influenced by a multitude of factors. Understanding these factors and using a combination of valuation methods is essential for arriving at a reasonable estimate of the company’s value. While challenges remain, Alibaba’s strong financial performance and strategic initiatives position it for continued growth in the future. Monitoring the regulatory environment, competition, and macroeconomic conditions is crucial for investors seeking to understand the trajectory of the Alibaba Group net worth. Accurately assessing the Alibaba Group net worth requires a deep understanding of its business model, market dynamics, and the regulatory landscape.