Unveiling the Net Worth Required to Be in the Top 10 Percent

The question of what net worth is required to be considered among the top 10 percent of wealthiest individuals in a country, particularly in the United States, is a common query. It’s a benchmark that many aspire to reach, representing a significant level of financial success and security. However, defining this threshold is not as straightforward as it might seem. Various factors influence the figure, including economic conditions, geographic location, and the methodologies used to calculate wealth. This article will delve into the complexities of determining the net worth for the top 10 percent, examining different data sources and providing a comprehensive overview of what it takes to achieve this financial status. Understanding this benchmark can provide valuable insights into wealth distribution, financial planning, and the economic landscape.

Defining Net Worth

Before exploring the specific figures associated with the top 10 percent net worth, it’s crucial to understand what net worth actually encompasses. Net worth is a measure of an individual’s or household’s total assets minus their total liabilities. Assets include anything of economic value that a person owns, such as cash, savings and checking accounts, investments (stocks, bonds, mutual funds, real estate), retirement accounts (401(k)s, IRAs), and personal property (vehicles, jewelry, collectibles). Liabilities, on the other hand, are debts and obligations, including mortgages, auto loans, credit card balances, student loans, and other outstanding debts.

The formula for calculating net worth is simple: Assets – Liabilities = Net Worth. A positive net worth indicates that assets exceed liabilities, while a negative net worth signifies that liabilities outweigh assets. Net worth is a fundamental indicator of financial health and is often used to assess an individual’s or household’s overall financial standing.

Factors Influencing Net Worth

Several factors can significantly influence an individual’s or household’s net worth. Understanding these factors is essential for interpreting and contextualizing the figures associated with the top 10 percent.

Age and Career Stage

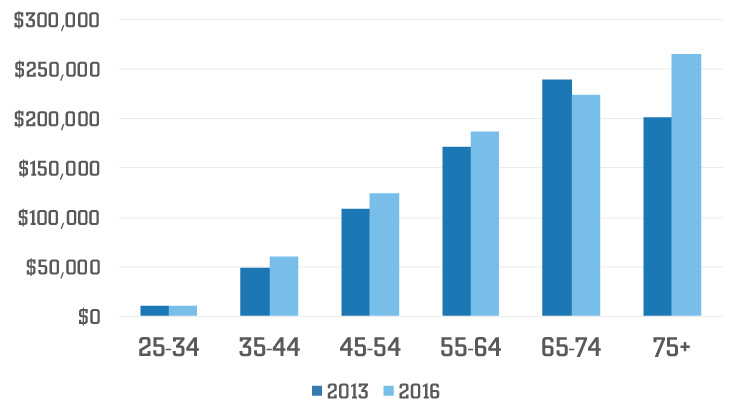

Age plays a significant role in net worth accumulation. Generally, individuals accumulate more wealth as they progress through their careers and approach retirement. Younger individuals typically have lower net worth due to factors such as student loan debt, lower earning potential early in their careers, and limited time to accumulate assets. As individuals age and advance in their careers, they often experience higher earnings, pay off debts, and accumulate more assets, leading to a higher net worth.

Education and Income

Education and income are closely linked to net worth. Higher levels of education often lead to higher earning potential, which in turn allows individuals to save and invest more, contributing to a higher net worth. Individuals with advanced degrees or specialized skills are often in higher demand and command higher salaries, accelerating their wealth accumulation.

Geographic Location

Geographic location can also significantly impact net worth. The cost of living, housing prices, and job opportunities vary widely across different regions. Individuals living in areas with high housing costs may need to allocate a larger portion of their income to housing expenses, potentially limiting their ability to save and invest. Conversely, individuals living in areas with lower costs of living may have more disposable income to allocate towards wealth accumulation. Furthermore, certain regions may offer more lucrative job opportunities, leading to higher incomes and faster wealth accumulation.

Investment Decisions

Investment decisions play a crucial role in net worth growth. Individuals who make informed investment decisions and diversify their portfolios are more likely to experience higher returns and faster wealth accumulation. Investing in a mix of assets, such as stocks, bonds, and real estate, can help mitigate risk and maximize potential returns. Additionally, taking advantage of tax-advantaged investment accounts, such as 401(k)s and IRAs, can further enhance wealth accumulation.

Savings Habits

Savings habits are fundamental to building net worth. Consistently saving a portion of income, even a small amount, can significantly impact wealth accumulation over time. Developing a budget and tracking expenses can help individuals identify areas where they can reduce spending and increase savings. Automating savings by setting up recurring transfers to savings or investment accounts can also make it easier to save consistently.

Estimating the Net Worth for the Top 10 Percent

Determining the exact net worth required to be in the top 10 percent is challenging due to the dynamic nature of wealth and the limitations of available data. However, several sources provide estimates based on surveys and statistical analysis.

Federal Reserve Data

The Federal Reserve’s Survey of Consumer Finances (SCF) is a widely used source for data on household wealth in the United States. The SCF is conducted every three years and provides detailed information on assets, liabilities, and demographic characteristics of U.S. households. Analyzing the SCF data can provide insights into the net worth distribution and the threshold for the top 10 percent.

According to recent SCF data, the net worth required to be in the top 10 percent in the United States is estimated to be around $1.3 million. This figure represents the net worth at which an individual or household surpasses 90% of all other households in terms of wealth. It’s important to note that this is an estimate and can vary depending on the year the data was collected and the methodology used.

Other Sources and Estimates

In addition to the Federal Reserve’s SCF, other sources provide estimates of the net worth required to be in the top 10 percent. These sources include financial institutions, research organizations, and media outlets. While the exact figures may vary slightly across different sources, they generally align with the SCF estimates.

For example, some financial institutions estimate that a net worth of around $1.2 million to $1.5 million is needed to be in the top 10 percent in the United States. These estimates are often based on proprietary data and analysis and can provide a more granular view of wealth distribution.

Factors to Consider When Interpreting Net Worth Data

When interpreting net worth data, it’s important to consider several factors that can influence the figures and their implications.

Inflation

Inflation can erode the purchasing power of money over time, so it’s essential to adjust net worth figures for inflation when comparing data across different years. Failing to account for inflation can lead to misleading conclusions about wealth accumulation and the relative standing of individuals or households.

Cost of Living

As mentioned earlier, the cost of living varies significantly across different regions. A net worth that may be considered high in one area may not be sufficient to maintain a comfortable lifestyle in another area with a higher cost of living. Therefore, it’s important to consider the cost of living when evaluating net worth data and comparing wealth across different regions.

Debt Levels

Net worth is calculated by subtracting liabilities from assets. High levels of debt can significantly reduce net worth, even if an individual or household has substantial assets. Therefore, it’s important to consider debt levels when interpreting net worth data. Individuals or households with high levels of debt may have a lower net worth than those with similar assets but lower debt levels.

Investment Performance

Investment performance can significantly impact net worth growth. Individuals who make wise investment decisions and diversify their portfolios are more likely to experience higher returns and faster wealth accumulation. However, investment performance can also be volatile, and market fluctuations can impact net worth. Therefore, it’s important to consider investment performance when evaluating net worth data and assessing the long-term prospects for wealth accumulation.

Strategies for Increasing Net Worth

For those aspiring to increase their net worth and potentially reach the top 10 percent, several strategies can be employed.

Increase Income

Increasing income is a fundamental step towards building net worth. This can be achieved through various means, such as pursuing higher education or specialized training, seeking promotions or new job opportunities, or starting a side business. Higher income allows individuals to save and invest more, accelerating wealth accumulation.

Reduce Expenses

Reducing expenses is another crucial aspect of building net worth. By tracking expenses and identifying areas where spending can be reduced, individuals can free up more money to save and invest. Creating a budget and sticking to it can help individuals stay on track and make informed spending decisions.

Pay Down Debt

Paying down debt is essential for increasing net worth. High levels of debt can significantly reduce net worth and limit the ability to save and invest. Prioritizing debt repayment, especially high-interest debt, can free up more cash flow and improve net worth.

Invest Wisely

Investing wisely is crucial for growing net worth. Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and maximize potential returns. Seeking professional financial advice can also be beneficial, especially for those who are new to investing.

Save Consistently

Saving consistently is fundamental to building net worth. Automating savings by setting up recurring transfers to savings or investment accounts can make it easier to save consistently. Even small amounts saved regularly can accumulate significantly over time.

The Broader Implications of Net Worth Distribution

Understanding the net worth distribution and the threshold for the top 10 percent has broader implications for society. It sheds light on wealth inequality, economic mobility, and the overall financial health of a nation.

Wealth inequality refers to the gap between the wealthiest individuals and the rest of the population. A large gap indicates significant disparities in economic opportunity and access to resources. Understanding the net worth required to be in the top 10 percent provides a benchmark for assessing wealth inequality and tracking changes over time.

Economic mobility refers to the ability of individuals to move up or down the economic ladder. A society with high economic mobility offers opportunities for individuals to improve their financial standing, regardless of their background. Analyzing net worth data and tracking changes in wealth distribution can provide insights into economic mobility and the factors that influence it. [See also: How to Increase Your Net Worth]

The overall financial health of a nation is closely linked to the net worth of its citizens. A nation with a healthy population, characterized by a strong middle class and opportunities for wealth accumulation, is more likely to experience economic stability and prosperity. Understanding net worth distribution and the factors that influence it can help policymakers develop strategies to promote financial well-being and economic growth.

Conclusion

Determining the net worth required to be in the top 10 percent is a complex issue influenced by various factors, including age, education, geographic location, investment decisions, and savings habits. While estimates vary across different sources, a net worth of around $1.3 million is generally considered to be the threshold for the top 10 percent in the United States. However, it’s important to consider factors such as inflation, cost of living, and debt levels when interpreting net worth data. By understanding the factors that influence net worth and employing strategies to increase income, reduce expenses, pay down debt, invest wisely, and save consistently, individuals can improve their financial standing and potentially reach the top 10 percent. Furthermore, understanding the broader implications of net worth distribution can help promote financial well-being and economic growth for society as a whole.